Are You Ignoring the Future of Your Family Business?

Our recent survey* of family business owners revealed that the overwhelming majority — 88% — believe that being a family business is a key differentiator for their company, and is integral to its future success. Yet 80% of survey respondents also believe that the best leader for the future might not be a family member.

Read on to learn how survey respondents reported on these and other challenges inherent in creating a family business that’s built to last.

Factor in the family and business dynamics

If you own a family business, you might be nodding your head in agreement. Do you have non-family employees that outperform your family employees? Do you have family members who feel entitled to a future role with the company, even though they don’t have the skills or work ethic? Or, how about the non-employee family member who always seems to stick their nose in the business?

It’s not easy running a business, but as we learned in our survey, running a family business has its own set of challenges. For instance, maintaining family harmony while making good business decisions is a balancing act for many family business owners. Making sure that family employees, family non-employees, and non-family employees are treated fairly can create unwanted confusion and emotion.

Shore up a succession planning shortfall

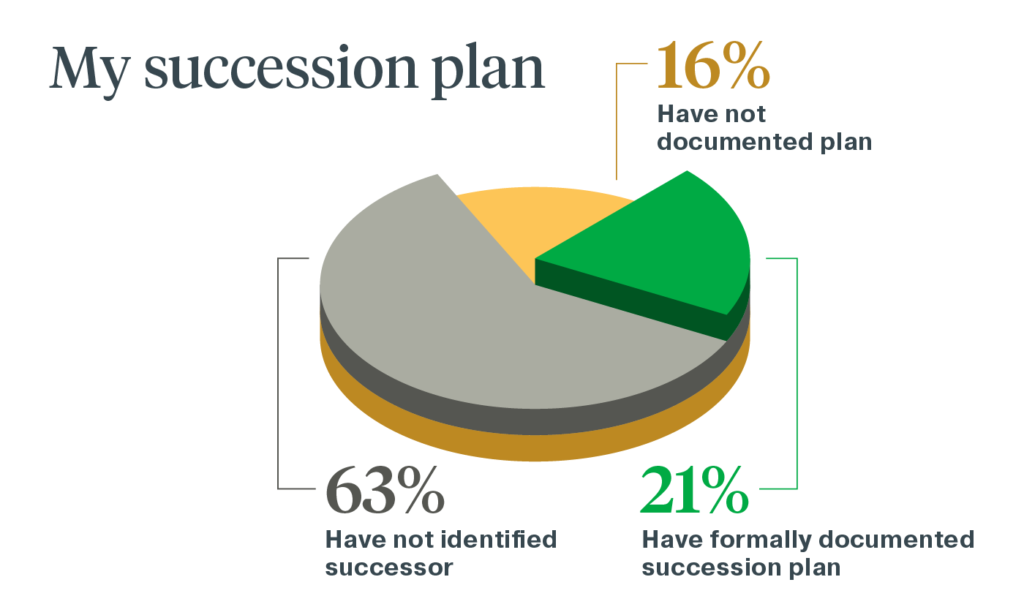

One way to cut through this family and business dynamic is with a well thought-out, documented and communicated succession plan. While 80% of our survey respondents indicated that they plan to transition their business to a successor, nearly two-thirds of them haven’t identified a successor. Worse still, almost half of those who have chosen a successor have only done it in their head.

The fact is, only 21% of the family business owners surveyed who intend to transition their company have a formally documented succession plan. While most have communicated their plan with their intended successor, some have not. And 79% don’t have a successor or a documented plan.

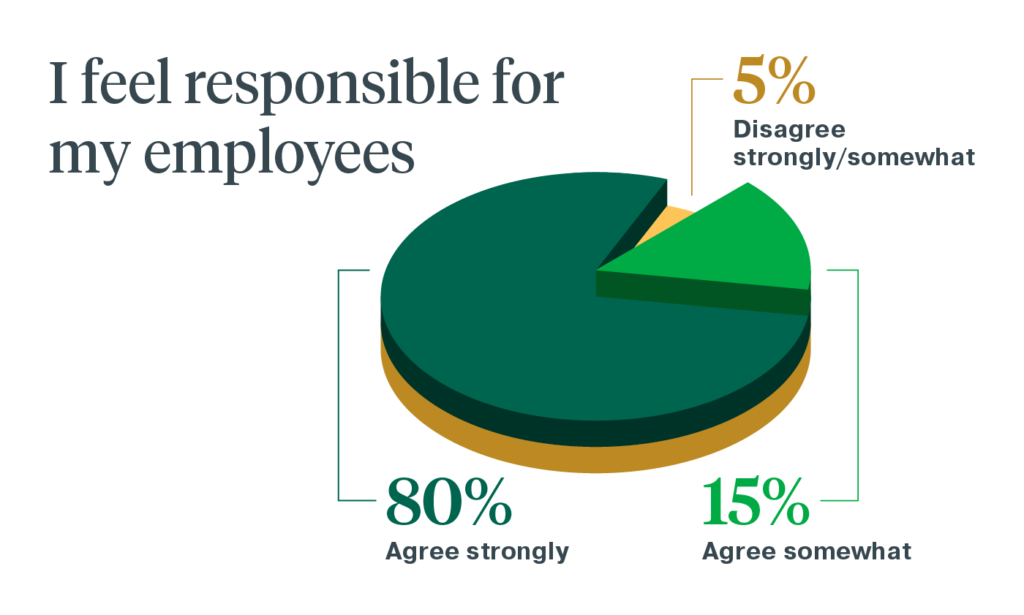

Although 80% of family business owners surveyed say they feel a very strong sense of responsibility toward their employees, this doesn’t seem to translate into succession planning. Sure, it’s difficult thinking about the future when so many things are going on, while running the day-to-day business operations. It may feel like there’s plenty of time, but there’s no better time than the present to protect the future of your business.

Consider the role of key person insurance

One way to act is to consider key person insurance (KPI), which can help you retain key employees, whether they’re part of the family or not, and ensure the continuity of your business. Our survey shows that more than half of the business owners (54%) with no KPI feel that key employees might leave, versus only 33% of those who have KPI. Unfortunately, of the 7 employee benefits included in our survey, KPI received the highest percentage of family business owners saying they have no interest in it, or don’t need it.

Key person insurance is just one potential way to increase the likelihood that the legacy of your family business will continue for generations to come.

For more details on the survey findings, download the white paper, “Family: A small word that can have a huge impact on business” (registration required), which takes a deeper dive into our survey and the dynamics of running a family business.

*Penn Mutual’s 2020 Family Business Survey was conducted between July 22 and August 10, 2020. Conducted with Family Business Magazine, the survey was intended to understand the challenges, expectations and behaviors of family-owned businesses and the people who lead them. The 305 respondents included business owners, partners and other high-level family employees.

This post is for informational purposes only and should not be considered as specific financial, legal or tax advice. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your situation. The information in this material is not intended as tax or legal advice. Always consult your legal or tax professionals for specific information regarding your individual situation.

3320940CC_NOV22