Explore the Living Benefits of Permanent Life Insurance

A common misconception about life insurance is that there’s nothing in it for you, the insured, and that the benefit is only experienced by others when you’re gone. The reality is that permanent life insurance can have many advantages for you while you’re alive.

Here are some of the ways permanent life insurance can help you throughout your lifetime.

Pay for education

You can borrow against the cash value* of your life insurance policy to offset or entirely cover the cost of higher education for you, your children or your grandchildren. You can even use it to pay for private school for your kids or any other education costs you might have. This could save you from taking out a loan to cover costs and can help make education more affordable for you and your family. And, if you have student loan debt, you can use the cash value from your policy to help pay it off.

Start a business

Have you always dreamed of starting your own business, but simply don’t have the money to launch it? The cash value of a permanent life insurance policy is an often overlooked source of funds for new business capital. You can also use to it grow an existing business. For example, you could expand your inventory, open a new location or fund equipment upgrades. If Walt Disney can borrow from his life insurance to create the most magical place on earth, you can also use your policy to make your dreams come true.

Cover time off

Family emergencies happen beyond your control. Life insurance can help you feel prepared if you ever find yourself in circumstances that require you to take a leave of absence from work and provide extended care to a loved one. You may even want to take extended personal leave to focus on raising children. The cash value from your life insurance policy can provide financial coverage whether your time off is expected or unexpected.

Boost retirement income

A permanent life insurance policy can benefit you in retirement as well. Perhaps you’re nearing retirement and concerned about covering your expenses. You could tap into the cash value of your policy to cover the first few years of retirement, allowing the funds in your 401(k) to potentially grow much longer. You could also postpone taking Social Security benefits, giving those benefits time to grow as well.

Give yourself options

The most important thing to know is that life insurance can serve many purposes throughout the course of your life. It can certainly help pay for funeral expenses and pay off your mortgage, but it can also make your dream vacation a reality or provide the funds for the start up on your goal list. It’s a versatile product that can give you financial options as your needs change through various stages of life.

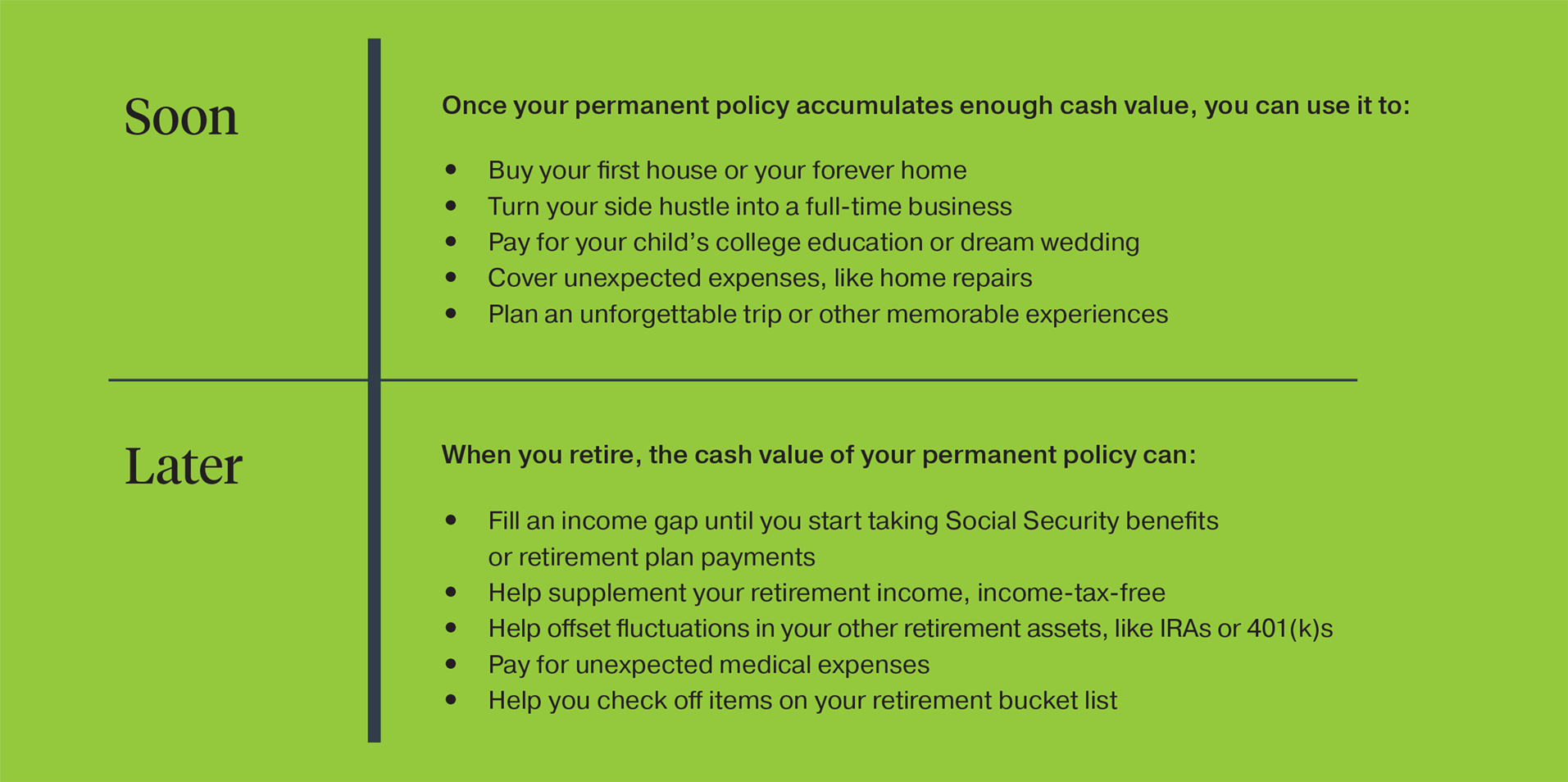

Check out some things permanent life insurance can do for you during your lifetime:

Interested in adding permanent life insurance to your current financial strategy? Talk with a financial professional today to explore what options are right for you.

*Accessing cash value will reduce your policy death benefit and values, may result in certain fees and charges and may require additional premium payments to maintain coverage. Ask your financial professional for details on accessing your cash value, including how it might impact the coverage guarantees and situations when the values you access could be taxable. Always consult your tax advisor before accessing a policy’s cash value.

This post is for informational purposes only and should not be considered as specific financial, legal or tax advice. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your situation. The information in this material is not intended as tax or legal advice. Always consult your legal or tax professionals for specific information regarding your individual situation.

4931725CC_SEP24