Have You Thought About the Benefits of Gifting Life Insurance?

It’s never too early to think about the future. Life events and milestones, like graduations and weddings, provide opportune moments to give memorable gifts with lasting impact. You might not be aware of just how valuable the gift of permanent life insurance can be for current and future generations. Not only can it provide a firm financial footing for the recipient during their lifetime, but it can also provide protection for their heirs in the future.

What a permanent life insurance policy can offer your loved ones

First and foremost, a permanent life insurance policy offers lifetime death benefit protection that’s payable to the beneficiaries income tax free. Additionally, this type of policy provides the potential for cash value accumulation, which the recipient can access income tax free during their lifetime for any reason such as funding an education, buying a new home, paying for a wedding or starting a new business.1

There are even more great benefits that you may not know about when giving the gift of life insurance to a loved one:

- It can lock in their insurability. Protecting their insurability while they’re young and healthy hedges against unforeseen health issues that might prevent them from getting life insurance later in life.

- It can guarantee lower premiums. It’s also more cost effective to buy life insurance when you’re young and healthy. Covering those first few years of premiums for a loved one can help them take advantage of these lower premiums.

- It starts building cash value early on. Starting younger gives the policy value that much more time to compound. This larger cash value might come in handy down the road if they’re faced with big expenses.

How a policy can be funded

A permanent life insurance policy can be funded as a lump sum to pay several years of policy premiums or as an annual contribution to cover the cost of specific premiums.2

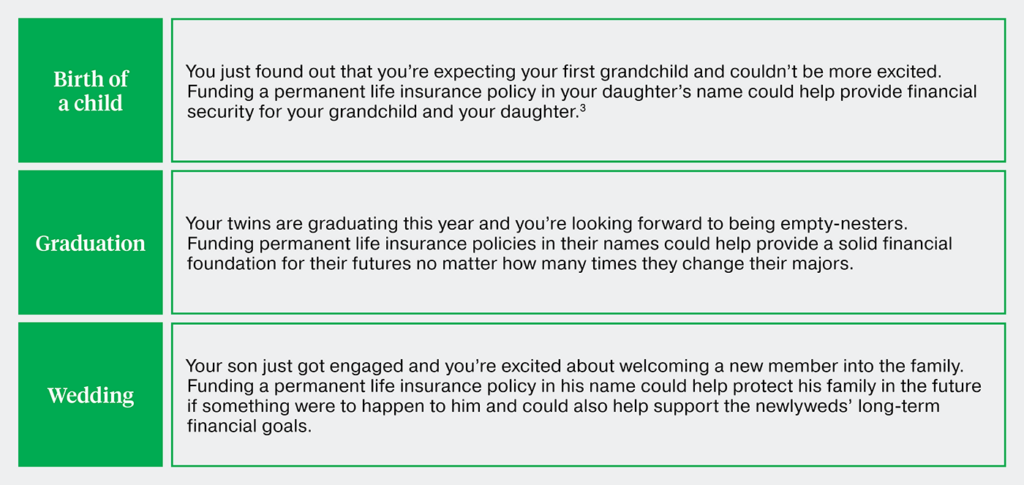

Big, celebratory moments in life — like birthdays, graduations and weddings — are a special time to honor loved ones with gifts that have a long-lasting, positive impact on their lives.

Let take a look at some examples:

Talk to your financial professional about options for gifting life insurance and the ways it can benefit your loved ones in the long run.

1Accessing cash value will reduce your policy death benefit and values, may result in certain fees and charges and may require additional premium payments to maintain coverage. Loans and other policy withdrawals may be taxable under certain circumstances. Ask your financial professional for details on accessing your cash value, including how it might impact the coverage guarantees and situations when the values you access could be taxable. Always consult your tax advisor before accessing a policy’s cash value or taking a loan from a policy.

2Depending upon the amount of the premium (gift), gift taxes may be payable. If the annual gift ceases, the recipient will be responsible for annual premiums to keep the policy in force.

3If the insured is a minor, additional rules that vary by state will apply.

The information in this material is for informational purposes only and is not intended as financial, tax or legal advice. Reference to the taxation of products in this material is based on Penn Mutual’s understanding of current tax laws. All guarantees are subject to the claims paying ability of the insurer. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your personal situation. Always consult your financial, legal or tax professionals.

5624643CC_APR25