How to Turn Life’s Milestones into Financial Opportunities

In life, there will always be things you can control and things you can’t. What you can control is how you plan for your financial future.

You might have already taken some pretty significant steps to help ensure the stability of your finances, and ultimately, your retirement. If you’ve purchased life insurance, an annuity or are contributing to your retirement plan, you understand the value of planning ahead. But there’s another thing you can do early on in the planning process to help give you a step up on securing your retirement income.

Plan according to your financial milestones

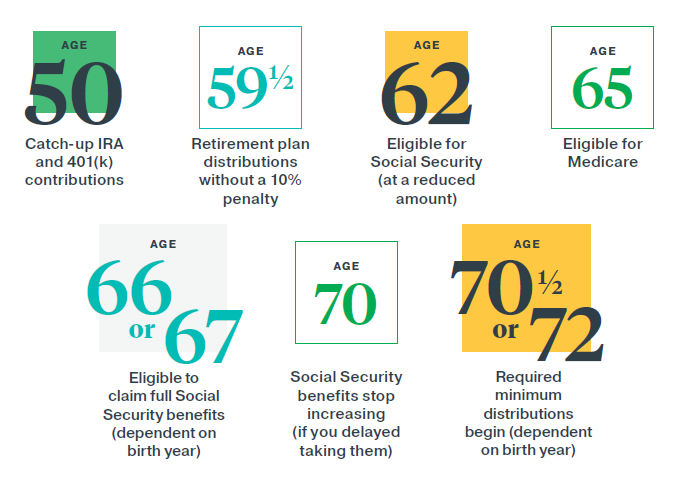

Financial milestones are moments in time when you’re able to make key decisions about your financial goals. They can align with birthdays, so you’ll want to work with your financial professional to determine how different financial milestones line up with your personal timeline. For example, on your 50th birthday, you can make “catch-up” contributions to your qualified retirement account.

Like birthdays, these important moments deserve to be celebrated because they’re an opportunity to continue shaping your financial goals for the future — and they can help you maximize your retirement income and retirement benefits.

Turn financial milestones into even bigger opportunities

When you know which financial milestones are ahead of you — and when they’ll hit your timeline — you can better prepare for them and plan accordingly. Work with your financial professional on a strategy to take full advantage of these important moments.

This post is for informational purposes only and should not be considered as specific financial, legal or tax advice. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your situation. Always consult your legal or tax professionals for specific information regarding your individual situation. Accessing cash value will reduce the policy death benefit and may require an additional premium to keep the policy in force.

4636472CC_MAR24