How to Use Life Insurance for Multigenerational Legacy Planning

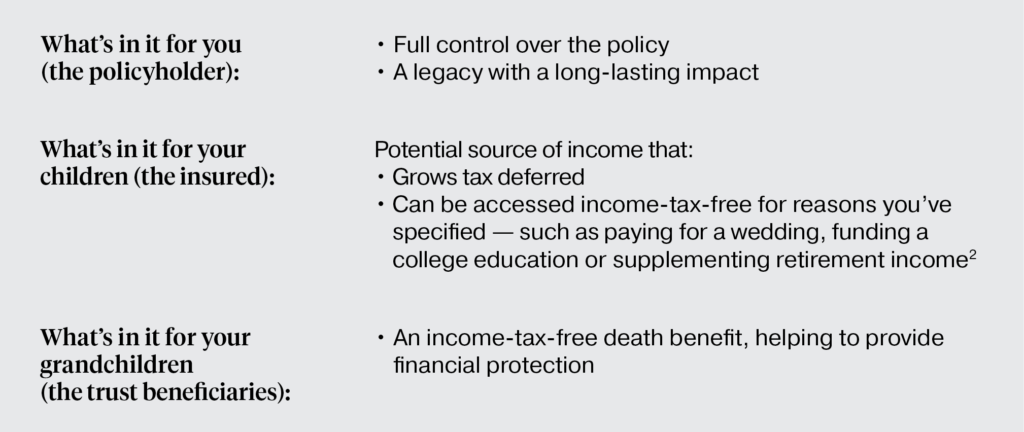

Like so many parents and grandparents out there, you want to make sure your children and grandchildren are financially secure. Fortunately, there’s an effective and efficient way to pass down wealth so both generations will benefit.

Permanent life insurance is the only financial vehicle that provides a death benefit and cash value accumulation — and may actually benefit all three generations: you, your children and your grandchildren. Let’s break down how it works.

Helps provide financial security across the generations

• You purchase a permanent life insurance policy and pay the premiums.1

• The policy insures the life of your children.

• Upon your death, the ownership of the policy is typically transferred to a trust through which your trustee honors your wishes for maintaining the policy.

Next time you’re searching for a legacy to leave your child and grandchild, remember that life insurance is truly the gift that keeps on giving and helping to protect their financial futures.

To get started, work with a financial professional who can answer any questions you might have and help you take care of all three generations in your family with permanent life insurance.

1Products are subject to state availability and may be subject to underwriting and certain eligibility requirements.

2Accessing cash value will reduce your policy death benefit and values, may result in certain fees and charges and may require additional premium payments to maintain coverage. Ask your financial professional for details on accessing your cash value, including how it might impact the coverage guarantees and situations when the values you access could be taxable. Always consult your tax advisor before accessing a policy’s cash value.

The information in this material is for informational purposes only and is not intended as financial, tax or legal advice. Reference to the taxation of products in this material is based on Penn Mutual’s understanding of current tax laws. All guarantees are subject to the claims paying ability of the insurer. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your personal situation. Always consult your financial, legal or tax professionals.

5270625CC_DEC24