Do You Know How to Avoid These Common Life Insurance Tax Traps?

One of the most favorable aspects of life insurance is its tax treatment: policy death benefits are exempt from federal income tax, policy cash value grows tax-deferred and it can generally be accessed on a tax-favored basis.1 Considering its tax efficiency, life insurance complements many popular tax planning strategies.

However, tax traps can still occur in common financial planning scenarios. Effective planning should aim to avoid these traps and preserve the unique tax benefits of life insurance. Working with a financial professional, policyholders and beneficiaries can review these planning considerations and avoid unexpected consequences.

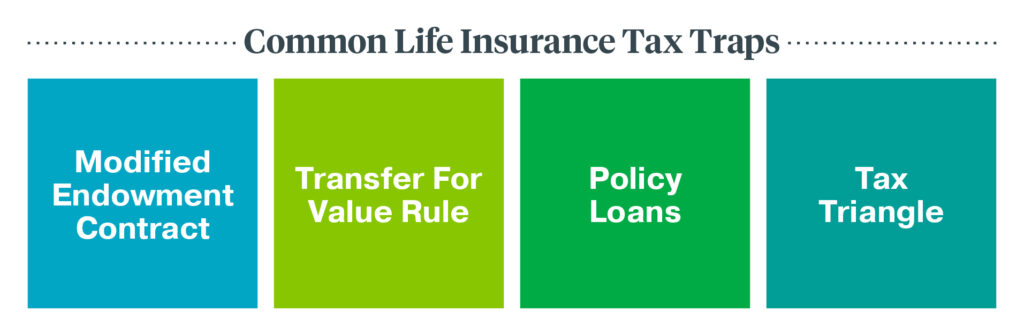

Let’s take a look at some common life insurance tax traps to avoid:

Modified Endowment Contract

The Modified Endowment Contract (MEC) rules limit how much premium can be contributed to a policy relative to the size of the death benefit without potential tax consequences. If a policy becomes an MEC, any amounts distributed from the policy (as distributions or loans) are subject to income tax regardless of who owns the policy.

Transfer for Value Rule

Another common tax trap is the transfer for value rule. If a life insurance policy is transferred from one person or entity to another, in return for something of value, then the death benefit is subject to income tax. There are a few exceptions. If the policy is transferred to the insured, a partner or partnership of the insured, or a corporation in which the insured is a shareholder or an officer, then they are exempt from this rule.

What’s tricky is not all transfers for value are obvious. No formal transfer of the policy is required. In some circumstances, a transfer for value can occur by naming a beneficiary or giving rights to all or part of the proceeds through a separate agreement. The consequence of triggering the transfer for value rule is that the beneficiary may be subject to income tax on a portion of the death benefit.

Policy Loans

Policy loans can create unintended tax consequences upon surrender, lapse or transfer. If a policy with an outstanding loan is surrendered or lapses, the outstanding loan is then treated as a distribution. The policy owner must recognize that income if the loan, plus any remaining cash value, exceeds the amount paid in to the policy. Policies with outstanding loans that are kept in force until the insured’s death do not create an income tax problem, and the proceeds will remain income tax free. However, the loan is repaid by reducing the death benefit by the amount of the outstanding loan.2

Tax Triangle

In life insurance planning, the “tax triangle” is a common trap. The triangle occurs when there are three different parties in a life insurance contract – one party as the insured, a second party as the policyholder and a third party as the policy beneficiary.

If the insured owns a policy on their own life, they can generally name anyone as the policy beneficiary. However, if a second party owns a policy on the insured then generally that same party should also be the beneficiary. Otherwise, upon the insured’s death the policy owner may be treated as making a taxable transfer of the death proceeds to the policy beneficiary – subjecting the death benefit to potential gift tax or income tax, depending upon the situation.

Work with your financial professional to understand your exposure to any of these or other potential tax traps.

1Provided the policy is not a Modified Endowment Contract. Accessing cash value will reduce your policy death benefit and values, may result in certain fees and charges and may require additional premium payments to maintain coverage. Ask your financial professional for details on accessing your cash value, including how it might impact the coverage guarantees and situations when the values you access could be taxable. Always consult your tax advisor before accessing a policy’s cash value.

2Loans and other policy withdrawals may be taxable under certain circumstances. Always consult your tax advisor before taking a loan from a policy.

The information in this material is for informational purposes only and is not intended as financial, tax or legal advice. Reference to the taxation of products in this material is based on Penn Mutual’s understanding of current tax laws. All guarantees are subject to the claims paying ability of the insurer. Depending on your individual circumstances, the strategies discussed in this presentation may not be appropriate for your personal situation. Always consult your financial, legal or tax professionals.

5515637CC_MAR25