Life Insurance Basics: How to Choose the Right Policy

When it comes time to purchase a life insurance policy, people often get overwhelmed by the number of choices available. It’s actually a good thing there are so many different types of life insurance: Everyone’s life is different, and even then, people’s needs change over the course of their lives.

I’d like to cover some of the basics of life insurance and explain the different types of policies available and what ones might be useful under what circumstances. There are basically two different types of life insurance: Term insurance and permanent insurance. Beyond that, there are several different types of permanent insurance.

Term Life Insurance

Term insurance provides a death benefit for a set number of years, usually ten, fifteen, or twenty years. Permanent life insurance provides a death benefit for a person’s entire life, and it also builds cash value. The comparison between renting or owning a home is apt: Term life insurance is like renting a home, while permanent life insurance is like owning a home. Renting can be cheaper in the short run, but you never build up equity in the home. Owning can be cheaper in the long run, and you have access to all the equity in the home.

While companies like Penn Mutual rightly champion the importance of permanent coverage, many folks start out by buying term insurance, just as they often start of renting rather than buying their home. Part of that is if they’re fixated only on protection, and term life insurance is an inexpensive form of temporary protection.

As situations and priorities change, a policyholder can convert that term insurance to permanent coverage without having to provide evidence of insurability. In effect, they’ve locked in their insurability when they bought the term, as long as they convert before the end of the term period. The permanent coverage will cost more than term, but it provides additional benefits that term cannot.

Permanent Life Insurance

Permanent life insurance combines the protection of the death benefit while building cash value that can be accessed throughout a person’s life for whatever they need it for. It is, as we say, for protection and possibilities.

Employers encourage people to put anywhere from four to eight percent of their salary into a 401K. A permanent policy can function much the same way. People should look at life insurance as a way to provide protection plus a savings element — not as a bill or a cost but more as an opportunity to put money in a vehicle that not only provides protection but also accessible cash value that can be used at any time. That outlook transforms the story away from, “Wow, that’s an expensive insurance policy” to “Wow, that’s an interesting vehicle that has the elements of life insurance protection plus cash value with growth on a tax deferred basis.”

With this perspective, life insurance suddenly becomes something more powerful. It’s not a pure investment. It’s not a pension or a defined contribution plan like a 401K, but it’s a hybrid of a protection vehicle that will provide a death benefit along with the ability to accumulate cash value that you can access when you need it.

The Different Types of Permanent Life Insurance

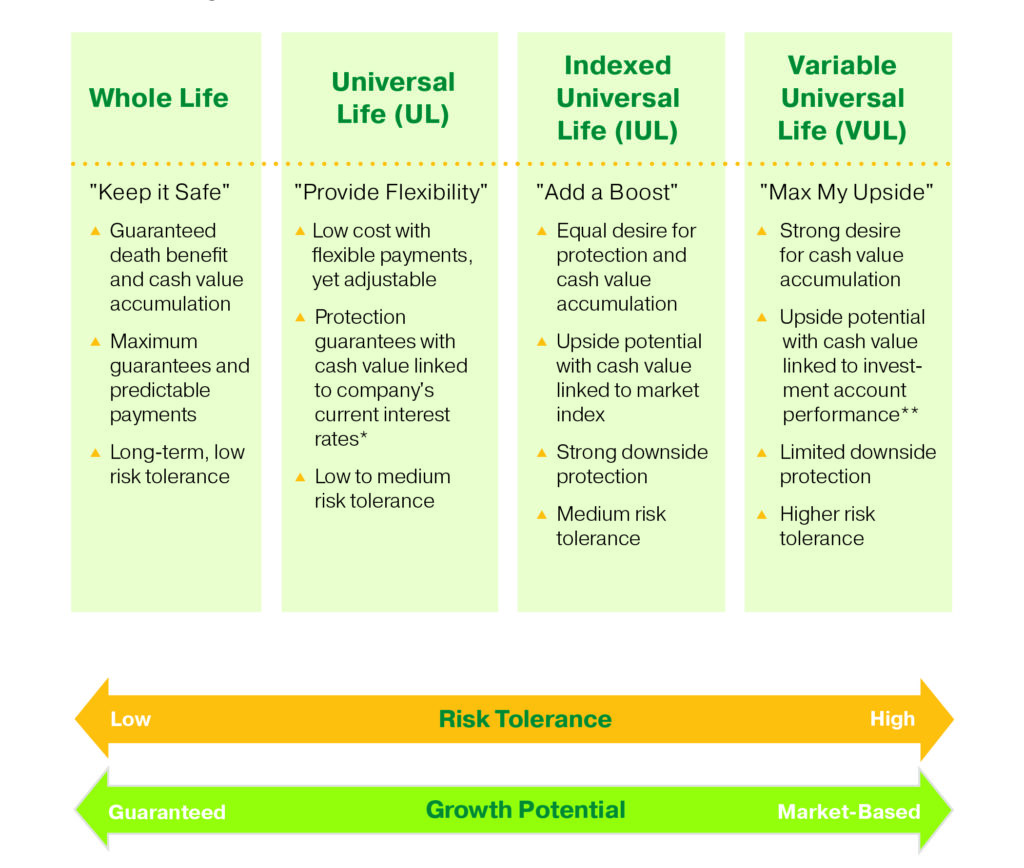

Penn Mutual offers a wide variety of products tailored to the client’s tolerance for market volatility in the accumulation of cash value. The four basic types of permanent life insurance are whole life, universal life (UL), indexed universal life (indexed UL) and variable universal life (VUL). See the below chart, which arranges the four life insurance options according to risk tolerance (from low risk tolerance to high) and growth potential (from guaranteed to market-based growth).

At the one end of the spectrum, whole life has guaranteed cash value. As long as you pay your premium and regardless of what happens with market interest rates, you get an increasing amount of guaranteed cash value each year.

If you go to the other side of the chart, for variable universal life, you have no guaranteed cash value, but you have potential for tremendous upside if the bond or equity markets perform well, where you could generate more cash value in that product than any of the other three. The tradeoff for that is you have limited, or no downside protection. Indexed UL and UL fit in between those two extremes.

It comes down to how comfortable you are with market volatility impacting the growth in the cash value of your life insurance. If you’re highly concerned about it, then whole life might be the product you choose. If you are willing to risk the possibility that your cash value might decrease for some periods of time in exchange for the potential of a large upside, then variable UL would be the choice. With variable universal life, you get to choose what funds to allocate your premiums from those offered by Penn Mutual.

If you are the sort of person who likes social proof for their decisions, I can tell you the product we sell the most of is whole life. In order of popularity, it’s whole life, indexed UL, UL, term and then variable UL.

Penn Mutual strives to provide a range of life insurance products that can meet any need. I invite you to contact your financial professional to learn more about choosing the right life insurance for your situation.

This post is for informational purposes only and should not be considered as specific financial, legal or tax advice. Depending on your individual circumstances, the strategies discussed in this post may not be appropriate for your situation. All opinions expressed in this post are solely those of the author and do not necessarily reflect the opinions of Penn Mutual, its affiliates or employees. Always consult your legal or tax professionals for specific information regarding your individual situation.

Insurance Products Are: Not FDIC insured, may lose value, not bank guaranteed, not a deposit and not insured by any federal government entity.

Life insurance policies contain exclusions, limitations, reductions of benefits and terms for keeping them in force. Accessing cash values may result in surrender fees and charges, may require additional premium payments to maintain coverage, and will reduce the death benefit and policy values. Loans are income tax free as long as policy is not a “modified endowment contract” (MEC) and policy must not be surrendered, lapsed, or otherwise terminated during the lifetime of the insured. Policy must not be a modified endowment contract (MEC) and withdrawals must not exceed cost basis. Partial withdrawals during the first 15 policy years are subject to additional rules and may be taxable. Excess policy loans can result in termination of a policy. A policy that lapses or is surrendered can potentially result in tax consequences. You should consult a qualified tax professional for tax advice on your own personal situation. All guarantees are based upon the claims-paying ability of the issuer.

Variable universal life policies are sold by prospectus, which contains detailed information about investment objectives and risks, as well as charges and expenses that investors should carefully consider. You should read the prospectus carefully before you invest or send money to buy a variable universal life policy. The prospectus is available from the insurance company or from your financial professional. The subaccounts of a variable universal life policy will fluctuate in value based on market conditions and may be worth more or less than the original amount invested if the annuity is surrendered. Read the prospectuses carefully before investing.

4680881CC_MAY24